I spend much of my time studying and comparing cash-back credit cards, so it takes a lot for a new credit card to surprise me. I almost hate to admit it, but the new Fifth Third 1.67% Cash/Back Card threw me for a loop.

Not because 1.67% Cash/Back has a revolutionary rewards program or stunning benefits lineup. That’s why I hate to admit it: the novelty is basically a gimmick, and right there in the name of the card.

You just don’t see credit cards with a flat 1.67% cash-back rate very often. 1.5%, sure. 2%, definitely. But 1.67%? Just what is Fifth Third thinking?

I had no idea until someone much better at math reminded me that 5 divided by 3 equals 1.67. 5/3…Fifth Third…1.67.

You get it now. Turns out it’s right there in the logo too. (And the “Cash/Back” bit is consistent with the slash-in-the-name thing too.) Hats off to Fifth Third’s marketing department for this one, you’re smarter than I am.

What Is the Fifth Third 1.67% Cash/Back Card?

This might shock you, but the Fifth Third 1.67% Cash/Back Card is a cash-back credit card that earns unlimited 1.67% cash back on all eligible purchases. Fuel, groceries, takeout, travel — it all earns at the same rate.

You must have a Fifth Third Momentum® Checking account to apply for the 1.67% Cash/Back Card. This is an inconvenience if you don’t want or need another bank account, but Momentum Banking is fee-free and easy to open online, so it might not be a dealbreaker. If and when you upgrade to Fifth Third Preferred Banking, which has harder-to-avoid fees, you may qualify for the 2% cash-back Fifth Third Preferred Cash/Back Card.

Otherwise, the 1.67% Cash/Back Card is a pretty standard Mastercard. Here’s what else you should know before you apply.

What Sets the Fifth Third 1.67% Cash/Back Card Apart

The Fifth Third 1.67% Cash/Back Card isn’t a revolutionary credit card, but it does have three unusual or unique features worth noting:

- Unlimited 1.67% Cash Back. Novelty, gimmick, whatever you want to call it — the 1.67% Cash/Back Card goes where few if any cash-back credit cards have gone before it.

- Tied to a Specific Fifth Third Bank Account. This is not a good thing in my book, unless you’re already a Fifth Third Momentum Checking customer. Popular no-annual-fee cash-back credit cards generally don’t require you to have a specific bank account before you apply.

- Solid Introductory Balance Transfer Promotion. The 1.67% Cash/Back Card has a 0% APR introductory promotion on balance transfers for 12 months from account opening. That’s one of the better balance transfer offers in the category.

Key Features of the Fifth Third 1.67% Cash/Back Card

Let’s explore the most important features of the Fifth Third 1.67% Cash/Back Card in more detail.

Earning Cash Back

The 1.67% Card’s rewards program couldn’t be simpler. All eligible purchases earn 1.67% cash back, with no caps on earning potential and no bonus rewards categories or tiers to complicate things. Rewards don’t expire as long as your account remains open and in good standing.

As flat cash-back rates go, 1.67% occupies a middle ground between the relatively low 1% to 1.5% rate offered by many entry-level cards and the 2% to 2.5% offered by more generous cards. It’s nothing special, but not insultingly low.

Redeeming Cash Back

You can redeem cash back in any amount, at any time. The best way to do this is by setting up automatic redemptions, zeroing out your rewards balance each month and reducing the time investment of redeeming to zero as well.

Intro Balance Transfer Offer

The 1.67% Card has a 0% APR introductory offer on balance transfers made during the first 12 months of account opening.

You won’t pay interest on these transfers until the 13th billing cycle after your account is open. Be sure to pay off any transferred balances in full during the period though, or you’ll have to pay deferred interest on any unpaid portion after the introductory period ends.

There’s no corresponding promotion for purchases, so this isn’t the right card if you’re planning to make a big purchase early on in the hopes that you won’t have to pay interest on it.

Cell Phone Protection

This card’s signature value-added benefit is a relatively generous cell phone protection plan worth up to $1,000 per year. The maximum per claim is $800, less a $50 deductible, and you’re limited to two claims per year.

The catch: You have to pay your cell phone bill in full with your 1.67% Card each month for the benefit to remain in effect. If a month goes by without a cell phone bill payment appearing on your statement, coverage no longer applies.

Contactless Payments

Link your 1.67% Card to your mobile wallet to make contactless tap-to-payments with your phone anywhere it’s possible. The card is compatible with Google Pay, Apple Pay, and Samsung Pay.

Important Fees

There’s no annual fee or foreign transaction fee. The latter isn’t standard for a basic cash-back card, so it counts as a solid perk, especially if you plan to travel outside the United States.

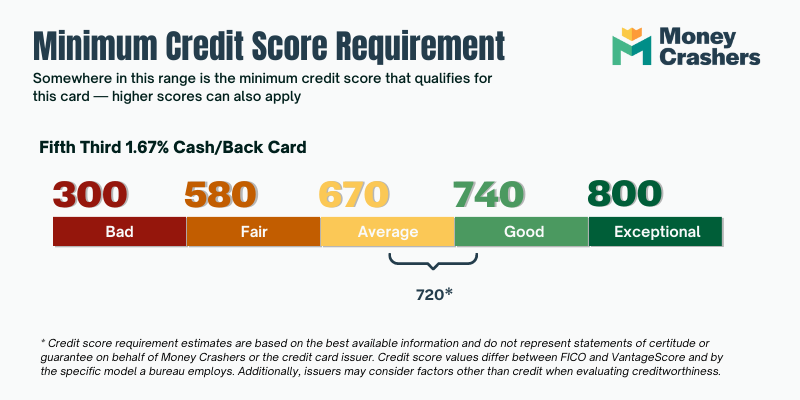

Credit Required

The 1.67% Cash/Back Card requires decent (or better) credit. You’ll have trouble qualifying for this card if your FICO score is below 700.

Advantages of the Fifth Third 1.67% Cash/Back Card

The 1.67% Card’s bright spots include its decent cash-back rate, solid balance transfer promotion, and no annual fee.

- 1.67% on All Eligible Purchases. The name says it all. Every purchase earns 1.67%, every day, with no caps or restrictions on how much you can earn.

- No Annual Fee. The 1.67% Card doesn’t charge an annual fee. This is par for the course for this type of cash-back card, but still worth noting as an advantage.

- 0% APR on Balance Transfers for 12 Months. Balance transfers made early within 12 months of account opening don’t accrue interest for the entire period, making this a solid if not spectacular balance transfer card. Just be sure to pay off transfers in full before the intro period ends or you may be on the hook for deferred interest.

- Easy to Redeem Cash Back. You can redeem cash back in any amount, at any time. Enroll in automatic redemption to set and forget your monthly redemptions.

- No Foreign Transaction Fees. This card doesn’t charge foreign transaction fees, which is excellent news if you plan to travel outside the United States or make purchases from overseas merchants.

- Comes With Complimentary Cell Phone Protection. Pay your cell phone bill in full each month with your 1.67% Cash/Back Card and enjoy complimentary cell phone protection worth up to $800 per claim and $1,000 per 12-month period.

Disadvantages of the Fifth Third 1.67% Cash/Back Card

The 1.67% Card has some notable drawbacks that could give you pause. Consider them carefully before you apply.

- Requires a Fifth Third Bank Account. You must open a Fifth Third Momentum Checking account before applying for this card. Most popular cash-back credit cards don’t require a linked bank account as a condition of approval, so this is a definite drawback for people who aren’t already Fifth Third customers.

- No Bonus Rewards. 1.67% cash back is a fine rewards rate, but it would be nice if you could do better. And you can’t with this card.

- No Sign-up Bonus. This card doesn’t have a sign-up bonus either. The best no-annual-fee cash-back credit cards do.

- No 0% APR Purchase Promotion. The 1.67% Card’s intro balance transfer promotion doesn’t pair with a comparable purchase promotion, as is often the case. A clear drawback if you’re planning a major purchase.

How the Fifth Third 1.67% Cash/Back Card Stacks Up

Before you apply for the Fifth Third 1.67% Cash/Back Card, see how it compares to another popular cash-back credit card: the Citi Double Cash Card.

| Fifth Third 1.67% Card | Citi Double Cash Card | |

| Rewards Rate | 1.67% on all eligible purchases | 1% back when you make purchases + 1% back on balance payments |

| 0% APR Offer | 0% for 12 months on balance transfers, then regular APR | 0% for 18 months on balance transfers, then regular APR |

| Sign-up Bonus | None | None |

| Annual Fee | $0 | $0 |

Other Credit Cards to Consider

The Double Cash and 1.67% Cash/Back Cards aren’t the only fish in the cash-back credit card sea, of course. Consider these alternatives as well.

Final Word

The Fifth Third 1.67% Cash/Back Card has an unusual cash-back rate and requires a specific Fifth Third bank account (Momentum Checking) to apply. Beyond those two telltale features, there’s not a lot to write home about here.

For me, that’s where the conversation ends. It’s not worth my time (or the hit to my credit score) to apply for a credit card that doesn’t stand out in many ways and indeed requires me to apply for a second bank account before I get my hands on it.

But were I an existing Fifth Third customer or someone planning to switch to Fifth Third anyway, I’d be happy I had the option. The 1.67% Card isn’t a terrible product — it’s just not one to go out of your way for.