Even in the best of times, carrying a credit card balance is best avoided. It’s expensive, stress-inducing, and can damage your credit score.

These are definitely not the best of times. In fact, based on prevailing credit card interest rates, 2023 is the worst year to carry a credit card balance since at least 1995, and probably longer. (Our data stops there, unfortunately.)

Just how high are credit card interest rates? How did they get so out of control? Is there anything to be done about it? Read on for the answers.

What Is the Average Credit Card Interest Rate Now (2023)?

The average credit card interest rate across all U.S.-issued credit cards was 19.07% in November 2022, according to the Federal Reserve Bank of St. Louis.

That’s the most recent month we have data for.

As we’ll see, credit card interest rates have risen sharply since early 2022, jumping anywhere from 10 to 30 basis points on average per month. (A basis point is one-hundredth of a percent, so a jump from 19.06% to 19.07% is a jump of one basis point.) So the actual average credit card interest rate right now is almost certainly higher than 19.07%.

Don’t hold your breath waiting for the trend to reverse. Credit card interest rates are closely tied to the federal funds rate, that all-important benchmark interest rate set by the Federal Reserve Bank of the United States (the Fed, for short). The Fed will probably stop hiking the federal funds rate in 2023, but cuts aren’t expected until 2024, so prevailing interest rates (including credit card rates) will remain high for a while longer.

What Has the Historic Credit Card Rate Been and Why Is It Skyrocketing Now?

Since 1995, credit card rates have tracked within a relatively narrow band: about 12% on the low side and roughly 16% on the high side.

Before 2022, the last time average credit card rates topped 15% for any length of time was 2001, as the dot-com bubble deflated and the Fed cut rates to ward off recession. They remained low through most of the rest of the 2000s, fueling a consumption boom that ended with the Great Financial Crisis. After a peak in 2010, they took a long, low dip below 13%. They didn’t rise again in any sustained fashion until 2017.

In hindsight, 2017 (ish) marked a turning point for the relationship between credit card interest rates and the federal funds rate.

Previously, credit card rates tended to rise when benchmark rates (like the federal funds rate) rose and fall when benchmark rates fell, but the relationship wasn’t strong or even particularly clear. That changed in 2017 and 2018, when the Fed began hiking rates to tamp down inflation. Credit card issuers quickly followed suit and raised their own rates, almost in lockstep with the Fed.

Then came March 2020 and the onset of the COVID-19 pandemic. In a series of emergency meetings, the Fed slashed the federal funds rate to near zero in a desperate attempt to prevent economic collapse. The federal funds rate remained near zero until March 2022.

Credit card interest rates barely budged during this period. For whatever reason — greed, enlightenment, a mix of both — credit card issuers realized they didn’t have to drop rates just because the Fed did. Other factors, like a new generation of subprime credit cards with high interest rates and higher maximum interest rates on mainstream credit cards, helped solidify the new floor for credit card rates.

That floor became a springboard in 2022. In March, as the inflation rate mushroomed out of control, the Fed launched its most aggressive rate-hiking campaign in years. It raised the federal funds rate seven times in 2022, from near zero to around 4.00%.

Like clockwork, each “Fed day” announcement of yet another federal funds rate increase brought a wave of corresponding credit card rate hikes. Credit card rates ended the year about 400 basis points higher than they began it — coincidentally (or not) about the same numeric increase as the federal funds rate.

Fun Fact: Credit Card Interest Rates Average 11.5% Above the Fed Funds Rate

Since the mid-1990s, the gap between the federal funds rate and the average credit card interest rate has averaged 11.5%.

Though the relationship has grown stronger since 2017, many other factors continue to confound it, like the prevalence of 0% APR introductory offers and broader availability of high-APR subprime cards. But it’s still useful to look back at the multi-decade dance between credit card rates and the federal funds rate.

From 1995 until 2000, credit card interest rates didn’t fluctuate much as a function of the federal funds rate. The gap briefly narrowed in the early 2000s, then expanded in the aftermath of the dot-com recession, probably because credit card issuers tightened their underwriting standards as the Federal Reserve cut rates.

The gap really narrowed in the mid-2000s, hitting a series low of 7.8% in late 2006. This also (roughly) marked the peak of the housing bubble. The gap shot up in 2007 and 2008 as the economy soured, the Fed cut rates, and credit card issuers papered over losses by boosting APRs for existing cardholders. The gap widened to a crisis high of about 14% in early 2010, then dipped and remained stable around 12% until late 2017.

Today, the gap between the federal funds rate and the average credit card interest rate is higher than ever: 15.3%, and still rising. I’d wager it tops 16% before leveling off, and I wouldn’t be surprised if it approached 17%.

Credit Card Debt Has Skyrocketed Since 2021…

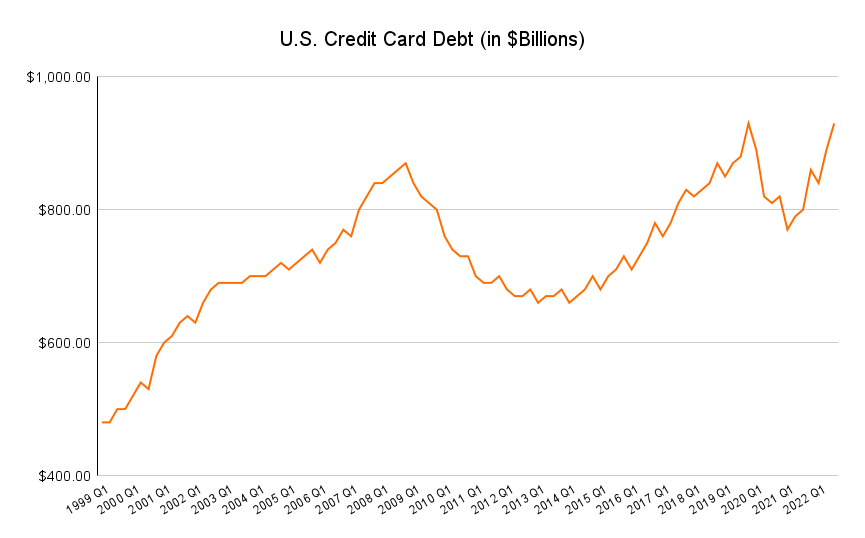

The spike in average credit card interest rates and the widening gap between credit cards and the federal funds rate both come as average credit card debt has skyrocketed in the United States.

Total U.S. consumer credit card debt hit $930 billion in Q3 2022, an increase of $43 billion over the previous quarter. That’s more than $6,000 in credit card debt per person. And at this rate of increase, it’s almost certain to top the previous all-time high of about $950 billion set in 2019 — if it hasn’t already.

…And Become More Expensive Too

Americans’ collective credit card debt burden is far more expensive than it was back in 2019, when average interest rates were 300 basis points lower.

Let’s say your current credit card balance is $10,000. At 19% interest and a $260 monthly payment, you’d need about 5 years to pay off the entire balance, and you’d pay $5,240 in interest alone ($15,240 total). Drop your monthly payment to $200 and you’d need more than 8 years to pay off the balance, dropping $9,435 ($19,435 total) along the way.

At 15% interest, your $10,000 balance would still be very expensive. You’d need to pay $238 per month to pay off your balance in 5 years, and you’d pay $4,054 in interest alone ($14,054 total). A $200 monthly payment would lengthen the payoff to 6.5 years and increase your interest cost to $5,527 ($15,527 total). But both 15% scenarios are a lot better than either 19% scenario.

Final Word

Know what’s better than 15% interest? 0% interest.

Fortunately for credit card balance-carriers, 0% APR credit card offers seem to grow on trees these days. If you have good credit, you should have no problem qualifying for a card with a long interest-free introductory period on purchases, balance transfers, or both.

So if you’re fed up with sky-high credit card interest rates and ready to get serious about paying down those carried balances for good, check out our lists of the top 0% APR credit cards and top balance transfer credit cards.