One of the issues that many people have been concerned with during this recession is what happens when a bank is seized by the FDIC. This is a matter of concern because the recession saw quite a few bank closings, and there are still hundreds of banks still on the FDIC watch list for potential failures.

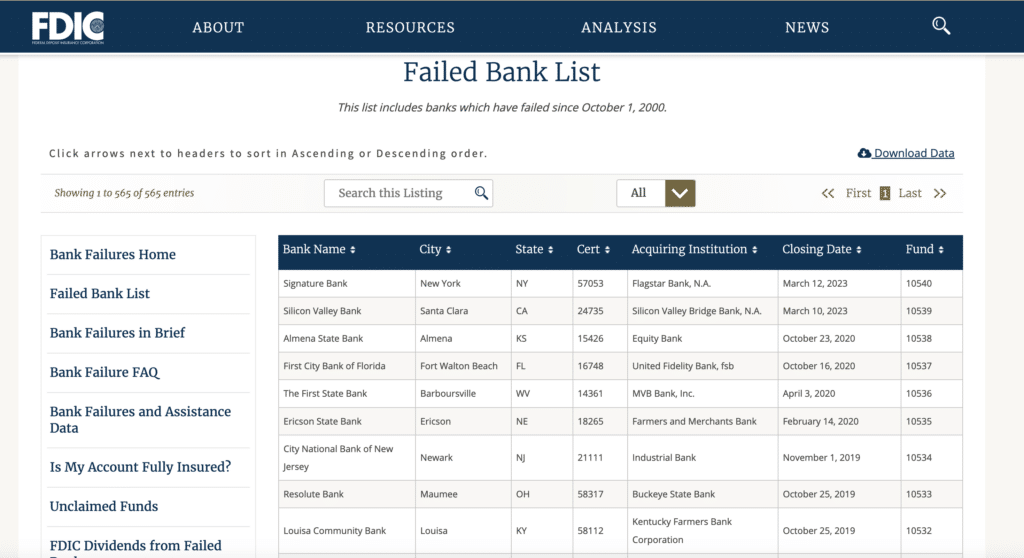

As of the March of this year according to the FDIC, there have been 565 bank closings since Oct 1st, 2000. While the worst is presumed to be over, you never know when your bank could be taken over by the FDIC.

Quick Note:

You can see the number of bank closings at the FDIC site under their list of Failed Banks.

The FDIC Closes a Bank

When the FDIC decides to close a bank, it tries to keep things quiet up until the last minute. This is to prevent a run on the bank, should consumers get wind of the impending action. When they are ready, the folks from the FDIC head into the bank and close down operations. This almost always takes place on a Friday. The FDIC tries to close down all branches of the bank at once, when possible. The bank is closed over the weekend.

The FDIC tries very hard to have another bank lined up to take over the failed bank. If this doesn’t happen, then bank is placed under FDIC conservatorship, and the FDIC runs the bank. This takes time and resources, though, so, when possible, the FDIC likes some other bank to take over.

Whether or not the FDIC has someone lined up, many banks are opened to the public the following Monday. FDIC people spend the weekend with bank employees, managers and owners, figuring out the state of the bank, organizing assets and liabilities.

Other agencies can get involved to help out, such as the Office of Comptroller of the Currency (to deal with credit cards), the Office of Thrift Supervision, and even state agencies. When the bank is reopened on Monday, customers can continue business as usual.

What Happens to Your Money

When the FDIC seizes a bank, your money is usually safe. The FDIC insures deposit accounts for up to $250,000 per depositor per bank (this amount has been made permanent), so if the bank fails, you can still get your money. If someone else has taken over the bank, then your accounts usually transfer to that bank, and you can decide whether or not to leave them there.

If the FDIC has conservatorship of the bank, there is a good chance that it will simply begin cutting checks to consumers and trying to sell other assets.

If your bank is closed by the FDIC, and no other bank takes over, you will get your money. You may have to stand in line for hours, or wait a couple of weeks to get your check. If the bank is closed, uncleared transactions may be returned.

You can have fees refunded, but there is a great deal of hassle involved, and you will need to make sure that all of your automatic debit transactions are updated (you may need to do this even if another bank takes over).

Additionally, since you don’t have access to your money while you wait for your check, you can lose out on interest that you might have earned on some deposit accounts. A new bank may require that you get a new CD (at a possibly lower rate), or adjust some of your other deposits and accounts.

| Step Number | Description | Impact on Customers |

|---|---|---|

| 1 | FDIC identifies a healthy bank to acquire the failed bank (if possible) | – Accounts transferred to acquiring bank – Continued access to funds – Notification of changes to account terms and conditions |

| 2 | FDIC liquidates the failed bank (if no acquiring bank is found) | – Insured deposits paid out up to the coverage limit – Possible receipt of a check, an account at another insured bank, or another form of payment |

| 3 | Handling of loans and other banking services | – Transfer of loans and services to acquiring bank (if bank is acquired) – Notification of changes to loan terms or payment information (if bank is liquidated and loans are sold to other banks) |

| 4 | Communication with customers | – FDIC communicates through the bank’s website, local news, and mailed notices – Customers must keep contact information up to date to receive important updates |

| 5 | Access to insured deposits | – Customers can typically access their insured deposits within a few days of the bank’s closure |

| 6 | Recovery of uninsured funds (if applicable) | – Possible recovery of some or all uninsured funds, depending on the proceeds from the bank’s liquidation – No guarantee of full recovery of uninsured funds |

| 7 | Resolution of the failed bank | – Overall resolution process can take months or even years, depending on the complexity of the bank’s assets and liabilities |

Debt Does Not Go Away

As you might imagine, your debt remains intact as well. It is either administered by the new bank that has taken over, or it is sold to another lender. Any loans you have with the failed bank will appear on the balance sheet, and be taken care of.

Investments made through the bank might be another story, though. Since these are not FDIC insured, you could sustain losses. You will have to double check.

Bottom line – Your Bank Account and the FDIC

Your cash deposits, as long as you do not exceed $250,000 insured. However, there are other costs, including those of time and convenience, associated with the FDIC seizure of a bank. You can prepare for such an eventuality by checking up on the health of your bank, and having a back up plan, just in case you have limited access to your money for a time.

FAQs – Bank Fails and FDIC Protection

When a bank is seized by the FDIC, it means that the bank has failed, and the FDIC steps in to manage the situation. The FDIC will either find a healthy bank to acquire the failed bank’s assets and liabilities or liquidate the bank and pay out insured deposits.

Yes, your money is safe up to the insured limit. The FDIC insures deposits at member banks up to $250,000 per depositor, per insured bank, for each account ownership category. This includes checking accounts, savings accounts, money market deposit accounts, and certificates of deposit (CDs).

The FDIC works quickly to resolve failed banks. In most cases, customers can access their insured deposits within a few days of the bank’s closure.

However, the overall resolution process can take months or even years, depending on the complexity of the failed bank’s assets and liabilities.

You can check if your bank is FDIC-insured by looking for the FDIC logo at your bank branch, on the bank’s website, or on your account statements. You can also use the FDIC’s BankFind tool (https://research2.fdic.gov/bankfind/) to verify your bank’s insurance status.