It’s nothing new for a cash-back credit card to blend bonus rewards on purchases with specific retailers and broader cash-back earnings in general-spending categories like fuel, restaurants, or travel. Two of my favorite store credit cards, the Amazon Prime Rewards Visa Signature Card and the Costco Anywhere Visa by Citi, do this very well.

It is a bit unusual — though welcome — for a cash-back card to let you choose from which retailers you earn bonus rewards. And even more unusual for the same card to let you choose your bonus general-spending categories.

The U.S. Bank Shopper Cash Rewards™ Visa Signature® Card does both, so it’s a bona fide breath of fresh air in the cash-back credit card space. It’s not perfect — its flexibility adds complexity, and it has an annual fee after the first year. But if you’re not impressed by your other cash-back card options, it’s definitely worth checking out.

What Is the U.S. Bank Shopper Cash Rewards Visa Signature Card?

The U.S. Bank Shopper Cash Rewards Visa Signature Card is a cash-back credit card that earns up to 6% cash back on eligible purchases.

You can earn 6% back on purchases with your choice of two participating retailers, 3% back on purchases in your choice of spending category, and 1.5% back on all other eligible purchases. Quarterly spending limits apply to the 6% and 3% tiers. You can update your choice of retailer and spending category each quarter as well.

The Shopper Cash Rewards Card has a $0 introductory annual fee for the first year, then a $95 annual fee each year thereafter. It has a nice sign-up bonus for new cardholders and some other perks worth mentioning too.

What Sets the U.S. Bank Shopper Cash Rewards Visa Signature Card Apart?

The Shopper Cash Rewards Card stands out for several reasons:

- 6% Cash-Back Tier Focused on Specific Retailers. Unlike most cash-back credit cards that aren’t cobranded (or sponsored by a particular merchant), the Shopper Cash Rewards Card has a cash-back tier that pays only on your choice of two participating merchants. If you spend heavily with any on the list, you can really rack up the rewards here.

- 5.5% Cash Back on Prepaid Hotel and Car Rentals Booked Through U.S. Bank. The Shopper Cash Rewards Card has the best cash-back rate for prepaid travel of any major cash-back credit card. The only catch is you have to book through U.S. Bank’s travel portal.

- Flexible Redemption Options, Including Instant Cash Back. The Shopper Cash Rewards Card has the usual lineup of flexible cash-back redemption options, plus a novelty: instant redemption that immediately reduces your net out-of-pocket cost for eligible purchases.

Key Features of the U.S. Bank Shopper Cash Rewards Visa Signature Card

These are the most important features of the Shopper Cash Rewards Card: sign-up bonus, regular cash-back program, credit requirements, fees, and more.

Sign-up Bonus

Earn a one-time bonus worth $250 after you spend $2,000 in eligible purchases within the first 120 days of account opening. The qualifying spend period stretches a bit longer than most other cash-back cards — 4 months instead of 3 months.

Earning Cash Back

The Shopper Cash Rewards Card has a multitiered (and admittedly complex) cash-back program.

6% Cash-Back Tier

First, you earn 6% cash back on the first $1,500 in combined eligible purchases each quarter with two retailers of your choosing. Participating retailers include (but aren’t limited to):

- Apple

- Amazon.com

- Best Buy

- Chewy.com

- Disney

- Home Depot

- Ikea

- Kohl’s

- Lowe’s

- Macy’s

- Restoration Hardware

- Target

- Walmart

- Wayfair

U.S. Bank has a persuasive graphic showing how purchases with various retailers in its 6% cash-back tier compare against those retailers’ store credit cards. Left out is the fact that most retailers’ store credit cards don’t cap rewards potential, as the Shopper Rewards Card does:

You can change your chosen retailers each quarter if you wish. You must activate your bonus cash-back earnings each quarter in any case, so that’s a good opportunity to make sure your old selections still work for you or update accordingly.

3% Cash-Back Tier

Next, you earn 3% cash back on purchases in your choice of general-spending category, such as gas and EV charging stations, utilities, and wholesale clubs. You can choose a single category each quarter and must activate to receive 3% cash back.

As with the 6% tier, bonus cash-back eligibility tops out at $1,500 in category spending each quarter.

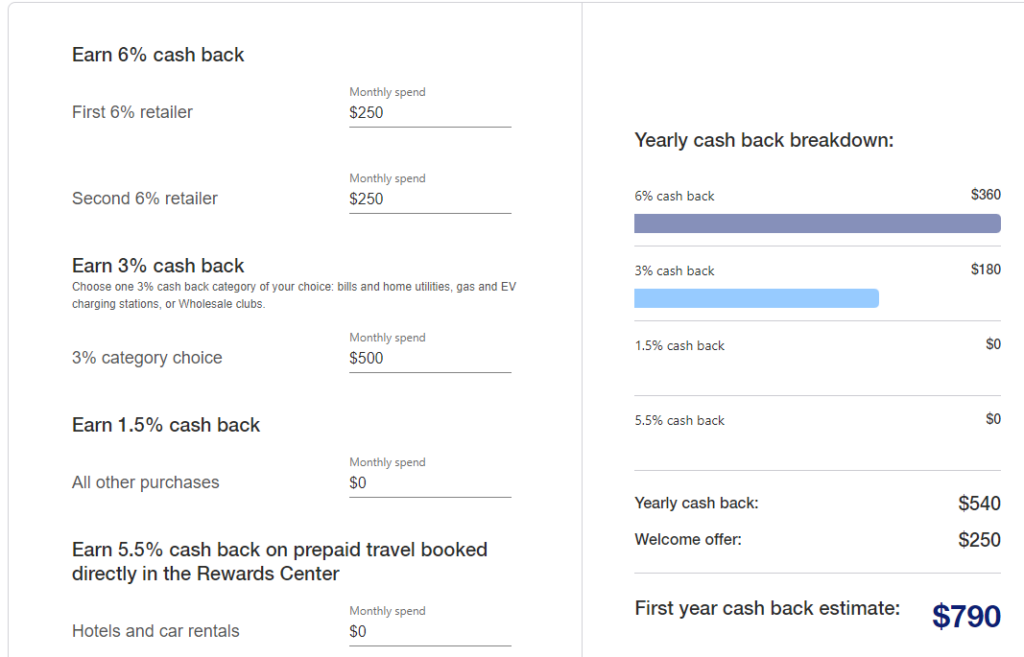

Even with the cap, the one-two punch of the 3% and 6% tiers offers excellent annual cash-back earning potential. Using U.S. Bank’s cash-back calculator, we see maximum potential 3% and 6% tier earnings of $540: $360 at 6% and $180 at 3%. Add in the one-time welcome bonus and you’re looking at $790 in total first-year earnings before you spend a dime in the 1.5% and 5.5% tiers.

5.5% Cash-Back Tier

This is a mini-tier that includes only prepaid hotel and car rental bookings made through the U.S. Bank Reward Center. To earn 5.5% cash back on these purchases, you need to search for, book, and pay for eligible travel purchases there — not directly with the hotel or car rental company, nor with any other third-party travel booking engine.

1.5% Cash-Back Tier

All other eligible purchases earn unlimited 1.5% cash back. This includes purchases above the quarterly spend caps in the 3% and 6% tiers, and purchases that would normally qualify for those tiers but don’t because you didn’t activate that quarter.

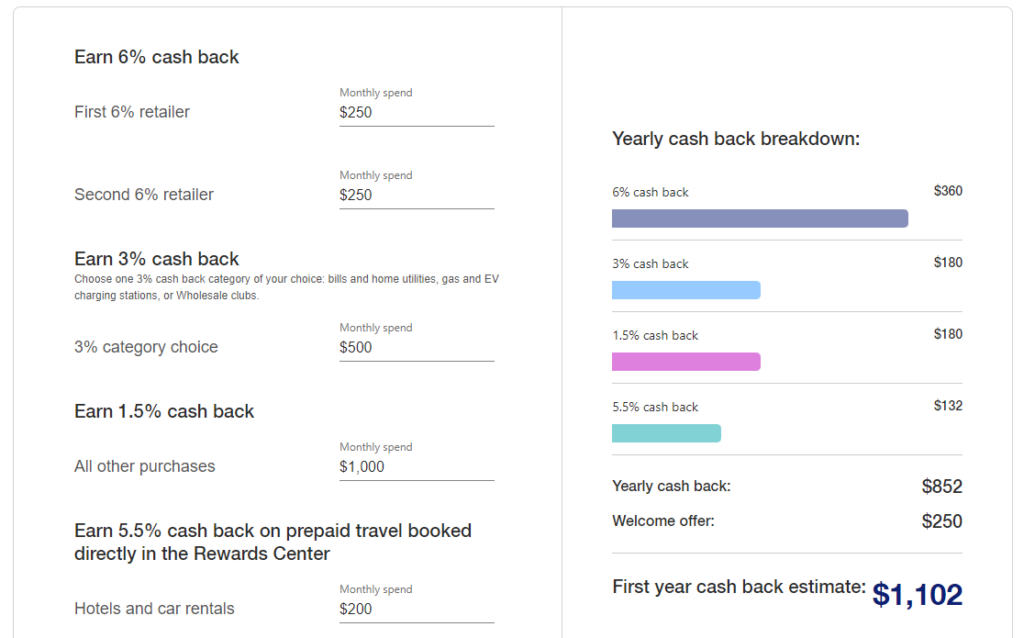

Turning back to U.S. Bank’s cash-back calculator, see how a modest annual spend of $12,000 in the 1.5% catch-all tier and $2,400 in the hotels-and-cars tier add up if we continue to max out the 3% and 6% tier spends:

Redeeming Cash Back

You can redeem accumulated cash back for statement credits, gift or rewards cards, and deposits to a linked U.S. Bank account. Pretty standard for a cash-back credit card

But the most convenient option is not standard: Real-Time Rewards, a special U.S. Bank feature that instantly redeems cash back on purchases as you make them. When you make a purchase eligible for Real-Time Rewards, you’ll receive a text message asking if you want to redeem toward it. Reply “REDEEM” and you’re good to go.

You must have enough rewards to cover the full amount of the purchase, so Real-Time Rewards is best for smaller transactions.

Important Fees

This card has a $95 annual fee after the first year. Foreign transactions cost 3% of the total transaction amount.

Credit Required

U.S. Bank doesn’t provide a specific minimum credit score for this card. It does say applicants need good or better credit to qualify. If your credit score is below 720 or so, you may have trouble getting your application approved.

Advantages of the U.S. Bank Shopper Cash Rewards Visa Signature Card

These are the best arguments in favor of the Shopper Cash Rewards Card. Decide for yourself if they outweigh the downsides.

- Multiple Opportunities to Earn Bonus Cash Back on Everyday Spending. The Shopper Cash Rewards Card has three main cash-back tiers and one mini-tier for prepaid hotels and car rentals booked through U.S. Bank. And the 3% and 6% tiers are customizable. Bottom line: You can fine-tune your cash-back experience here in a way that’s not possible with most other cards.

- 5.5% Cash Back on Prepaid Hotels and Car Rentals Booked Through U.S. Bank. This is the best rate on prepaid travel purchases made through a major credit card issuer’s online booking portal. It’s better than Chase, whose 5% return on prepaid travel was previously the gold standard.

- Good Baseline Cash-Back Rate (1.5%). This card’s baseline cash-back rate is decent at 1.5%. That’s better than the 1% baseline many other cards offer.

- Solid Welcome Offer. This card’s one-time welcome offer is solid too. With a moderate early spend threshold and an extra month to get there, it should be realistic for most new cardholders too.

- Flexible Redemption Options. The real standout here is Real-Time Rewards, which lets you redeem accumulated rewards at the point of sale — in person or online.

Disadvantages of the U.S. Bank Shopper Cash Rewards Visa Signature Card

The Shopper Cash Rewards Card does have a few notable downsides.

- Has a $95 Annual Fee After the First Year. The Shopper Cash Rewards Card has a $0 introductory annual fee for the first year. Then the fun ends, and you pay $95 per year moving forward. If you max out the 3% and 6% tiers (or even come close), you’ll still come out ahead, but the fee eats into your profit nonetheless.

- Rewards Program Is Complicated and Requires Some Work From Cardholders. The Shopper Cash Rewards Card’s rewards program is more complicated than the average cash-back card’s. It also requires manual activation each quarter. If you want a true set-it-and-forget-it rewards card, this ain’t it.

- 6% Cash-Back Category Has a Limited Number of Participating Merchants. The saving grace is that some of these participating merchants are among the biggest around: Walmart, Amazon, Best Buy, Target, Home Depot, Apple. Still, the limited selection is a constraint.

- No 0% APR Intro Offer. This card lacks a 0% APR intro offer for purchases or balance transfers. That’s a common feature of other cash-back cards and a clear downside.

How the U.S. Bank Shopper Cash Rewards Visa Signature Card Stacks Up

The Shopper Cash Rewards Card is kind of its own thing, but it’s most similar to other cash-back cards with rotating or customizable bonus categories. See how it stacks up to Bank of America’s custom cash back offering: the Bank of America® Customized Cash Rewards Credit Card.

| Shopper Cash Rewards | Customized Cash Back | |

| 6% Cash Back | On up to $1,500 in quarterly spend with your choice of 2 retailers | None |

| 3% Cash Back | On up to $1,500 in quarterly spend in your choice of 1 spending category | On up to $2,500 in quarterly spend in your choice of 1 spending category (cap shared with 2% categories) |

| 2% Cash Back | None | On up to $2,500 in quarterly spend at warehouse clubs and grocery stores (cap shared with 3% categories) |

| 1.5% Cash Back | All other eligible purchases | None |

| 1% Cash Back | None | All other eligible purchases |

| 0% Intro APR Promo | None | 15 months on purchases and balance transfers |

| Annual Fee | $0 for the first year, then $95 | $0 |

Other Alternatives to Consider

The Shopper Cash Rewards Card has some other close competitors too. Look into these cards before you apply:

Final Word

The U.S. Bank Shopper Cash Rewards™ Visa Signature® Card is the most innovative cash-back credit card to hit the market in some time. I particularly love the idea of choosing which merchants you’ll earn 6% back with each quarter.

I’m not pleased with all aspects of the Shopper Cash Rewards Card though. The manual enrollment requirement feels cheap alongside credit cards like Citi Custom Cash, which automatically do the work for you each month or quarter. And the overall complexity of the rewards program might be too much for credit card novices to make the most of.

But all in all, I’m bullish on the Shopper Cash Rewards Card. So far, it stands alone, but let’s see if imitators crop up in the months and years to come.