One would think that short-term goals are pretty easy to accomplish. Oh, really?

Think again. Short-term goals can be easily put off for a plethora of reasons. Research suggests this as 91% of people fail on their New Years’ resolutions.

When it comes down to getting short-term goals done, including short-term financial goals, one must implement some strategies to stay on task and on schedule.

Let’s start out by discussing some strategies for achieving important short-term goals and then move onto some short-term financial goals that are worth your time and effort.

Grab your notepad, you’re going need it!

What’s the Difference Between Short-Term and Long-Term Goals?

Goals can have different timelines attached to them. For example, a short-term goal may take months or even years to achieve, whereas a long-term goal may take 5-10 years or more to reach. It’s important to be realistic about how much time you need and plan accordingly in order to make sure you can stay on track with your objectives.

Additionally, breaking down each goal into smaller steps can help make the goals feel more achievable. It may also be helpful to track your progress and celebrate successes along the way! More on that in a sec.,,

How to Achieve Important Short-Term Goals

A short-term goal is a goal that shouldn’t take you long to complete. Generally, I would define a short-term goal as a goal that takes roughly less than a year to complete. Many times, these goals only take a month or a few weeks. They could only take a day or two.

Short-term goals usually have a very clear path toward their completion. You know exactly how you’ll accomplish your goal – every step you’ll need to take. You can break the goal down into smaller pieces and then track your progress along the way.

It’s crucial that each of your short-term goals follow the “SMART” goal format.

What Are Smart Goals?

Setting goals can be daunting, but with the SMART framework, you can turn your aspirations into achievable objectives that will help you make meaningful progress towards your dreams! SMART stands for Specific, Measurable, Achievable, Relevant, and Time-bound.

Think of SMART as your goal-setting BFF! When you have a SMART goal in mind, you know exactly what you want to achieve, how you will measure your progress, and when you will achieve it. Whether you want to improve your finances, health, or personal growth, SMART goals can help you stay focused, motivated, and accountable.

| SMART Goals | Stands For: |

|---|---|

| Specific | Clear and well-defined objectives |

| Measurable | Goals that have quantifiable targets |

| Achievable | Goals that are realistic and feasible |

| Relevant | Objectives that align with your values |

| Time-bound | Goals with specific deadlines |

Unfortunately, even when you know exactly how you’ll accomplish your goal, there are a number of circumstances that can get in the way. Let’s explore how to push through these difficulties and find success.

1. Find your daily energy peak and schedule accordingly.

Unless you’re like The Rock and have seemingly unending energy and strength, your productivity will rise and fall during the course of a day. I know, you didn’t like me telling you that, but someone had to, right?

Short-term goals are best made progress on during the times of day you have high to moderate energy. If you’re saving these goals for the times of day when you’re in a slump, let’s face it: you’re probably not going to get ‘er done. Save the low energy times for leisurely activities.

Okay, so how do you find your daily energy peak? Here’s what I recommend . . . .

Set a recurring alarm when you first wake up for every 30 minutes. Every time the alarm goes off, rate your energy level on a scale of 0 (being no energy) to 10 (being high energy) in a notepad or on graph paper. You can do this for one day or you can do it for a week and average out the results.

This will allow you to see how your energy level changes throughout the day and will allow you to make better decisions regarding how you allocate your time and tasks.

I would recommend working on your short-term goals during the times of day that your energy level is a “5” or higher.

I remember when I first started this blog I was a night owl and had the most energy as the sun was going down. Today, I find mornings work better for me. The lesson? Make sure you adjust your tasks to your changing energy levels. Who knows, you might make a radical shift like me over time.

2. Work on one short-term goal at a time.

I have no idea why multitasking is so praised in our culture. Multitasking, in my opinion, slows people down and produces poor results. It’s much better to work on one short-term goal at a time.

Besides, these are short-term goals – not long-term ones. You’ll be able to get them done pretty quickly and move on to other tasks in short order.

Of your short-term financial goals, it might be worthwhile to work on the quickest short-term goals first – the ones that take the least amount of time. This will give you a few quick wins, which should motivate you to press on.

3. Eliminate distractions soldier!

During my time in the Army National Guard, I learned how to focus. In battle, there’s nothing worse than not keeping your head in the game. When enemies are nearby, it’s critical that you stay on task and don’t daydream. There are plenty of distractions in battle – some of which are set by the enemy – and they need to be avoided.

When you’re working on your short-term goals – including financial goals – you should eliminate any distractions.

When you’re working at home, there are plenty of distractions. If you have kids, you know what I mean. Now, kids are a great distraction, but you should be very careful to make sure they don’t pull you away from your other obligations.

For example, let’s say you have a monthly budget meeting with your spouse. Instead of having the meeting when the kids are running around throwing toys at you, it’s probably best to wait until they go to bed.

Other potential distractions include technology. Yes, while technology can help you accomplish your financial goals – like analyzing your investments with Betterment or Personal Capital – it can also send you alerts that aren’t relevant to the task at hand (like text notifications from your second great aunt Martha).

How do you eliminate technological distractions? Well, if you have Apple devices, it’s pretty easy to do so. On your iPhone, turn on Do Not Disturb. You can do the same thing on your Mac. This way, you can focus in peace and get some work done!

4. Dig deep to find your motivation.

Just like when you’re working on long-term goals, you need to dig deep to find your motivation for short-term goals.

Why do you want to start a budget, for example? If you don’t have a good enough reason or reasons, trust me, the number-crunching will get old fast and you’ll probably give up before you develop a working budget.

Imagine the benefits, for example, of creating a working budget. How will it improve your relationship with your spouse? How will it keep you on track with your long-term financial goals? You’d be surprised by how many motivations you can find for even the most seemingly mundane short-term financial goals.

Important Short-Term Financial Goals

Alright, you’re all geared up. You have some strategies for achieving your short-term financial goals, but which goals are worth your while? That’s what we’re going to talk about next, partner.

1. Create a budget.

Surprise! Just kidding. You probably guessed this one.

The truth is that a working budget is the cornerstone of any good financial plan. A proactive budget not only tells you what you’ve spent, but it tells you what you should and should not spend – that’s huge.

Over time, by working your budget, you’ll find ways to cut your expenses and discover new motivations for raising your income.

2. Create a system to pay your bills on time.

Thanks to technology, there are all kinds of ways to pay your bills. You might pay through your bank’s online bill-pay feature, you might pay through the merchants’ websites, you might pay using your debit or credit card, you might pay with checks – or you might pay with your smartphone!

Chances are, you’re using a variety of methods to pay your bills. But do you have a solid system in place? How will you know if your credit card expired and a merchant can’t pull money through auto-pay? Are you trusting the banks and merchants to let you know when your card is about to expire?

Sure, that might work. But perhaps it would be better to put everything into a spreadsheet so you can keep track of all of your bills and how they’re paid. You can also create reminders to pay in your favorite app!

3. Get appropriate insurance policies for your family.

Do you have life insurance? Disability insurance? Umbrella insurance? How about renters insurance? These policies are commonly overlooked.

Find the best insurance and make sure you’re covered.

Short-Term Goal Examples

If you’re looking for real life short-term goal examples, you’re in luck! I polled some fans on the Good Financial Cents Facebook page and here’s some of the best ones:

Joseph Hogue from PeerFinance101.com shares his goals:

- Launch 4 short-format investing books as series in December

- Publish three posts per week to each blog

Financial goals

- Rebalance my portfolio allocation heading into my 40s. Still a year off (and I don’t generally try timing) but after almost 7 years of a bull market, will rebalance a year earlier and shift to new allocation

- Buy and renovate another rental property (in Medellin, Colombia)

Life goals

- Use social media more for personal connections and less for business (I realize the irony as I post this under my blog account)

- reconnect with a couple of high school friends

- start a hobby that isn’t related to personal finance or crowd-funding

Kate Dore from Cashville Skyline offers:

- Reach $200K net worth by the end of 2025.

- Renovate my basement to rent on Airbnb.

- Earn $10K side income before next year’s FinCon.

- Lose 20 pounds 🙂

Jacob Wade from iHeartBudgets.com shares his ambitious short-term goals:

- Finish Kitchen Remodel by end of 2022

- Pay Off Student Loans by end of 2022

- Launch online course for blog in March/April 2023

- MAX out Roth IRA for my wife and I in 2023

- Remodel Master bath in 2023

- Build deck/patio in backyard in spring 2023

- Build raised bed gardens in side yard in April 2023

- Get my butt into shape! Start in T-25 workout plan again

Those are some good examples of short-term goals. Here are some other examples you can use to kickstart your own short-term goal ideas:

| Financial Goal | Specific | Measurable | Achievable | Relevant | Time-bound |

|---|---|---|---|---|---|

| Emergency fund | Save $10,000 in a high-yield savings account | Yes | Yes | Yes | By age 30 |

| Retirement savings | Contribute at least 10% of your annual income to a 401(k) or IRA account, aim for $100,000 in retirement savings | Yes | Yes | Yes | By age 30 |

| High-interest debt | Pay off $5,000 of credit card debt | Yes | Yes | Yes | By age 30 |

| Credit score | Improve credit score to 750 or higher | Yes | Yes | Yes | By age 30 |

| Budgeting | Create a monthly budget, track spending, and save $5,000 | Yes | Yes | Yes | By age 30 |

| Education and career | Invest in education or career development | Yes | Yes | Yes | By age 30 |

| Investing | Invest $5,000 in stocks, mutual funds, or other investments | Yes | Yes | Yes | By age 30 |

| Home down payment | Save $20,000 for a down payment on a home | Yes | Yes | Yes | By age 30 |

| Estate plan | Create a will and estate plan | Yes | Yes | Yes | By age 30 |

| Living below your means | Reduce expenses by 10%, increase savings rate by 5% | Yes | Yes | Yes | By age 30 |

How I Keep Track of Short-Term Goals

My short-term goals fall into two categories: Quarterly (90 day goals) and weekly goals. Each quarter I list out my goals and then make sure my weekly goals stay on point to achieving those goals.

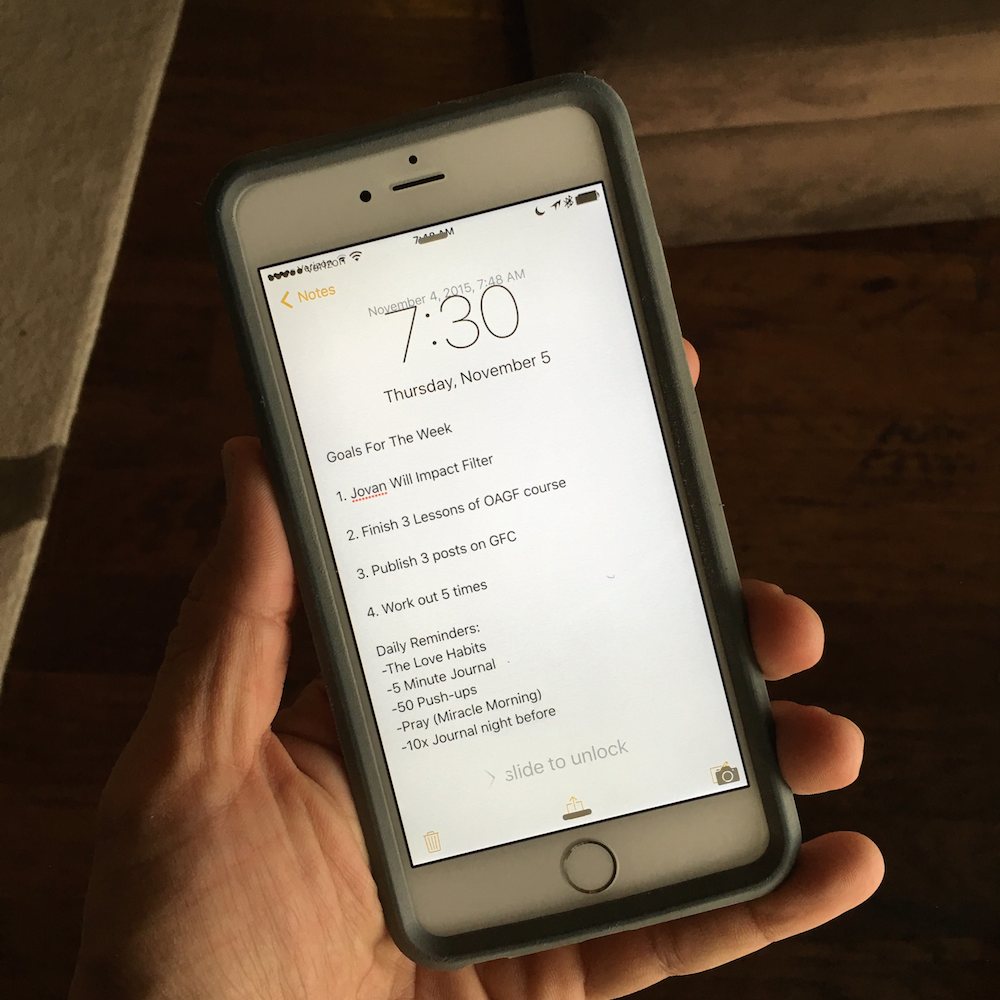

One easy way I’ve recently implemented of staying on point is creating my weekly goals Sunday night. I’l create a note on my iPhone, but that’s only the half of it.

I then take a picture (screenshot) of my weekly goals and make that the lock screen on my phone. That way every time I turn my phone on I see the top 4-5 goals I need to accomplish that week. Here’s how it looks on my phone:

You’ll also notice I list my daily reminders of my Success Habits I do each day.

These include doing The Love Habits with my wife, writing in my Five Minute Journal, knocking out 50 push-ups, praying, and completing my Crush Your Day PDF (from my 10x Goals Accelerator course) before I go to bed.

I’ve taken achieving my short-term goals to the next level because of this powerful combination.

The Bottom Line – Short-Term Goal Examples

So, there you have it! Setting short-term goals is an excellent way to achieve your long-term vision, improve your skills, and build momentum towards success.

By following the SMART framework, you can turn your aspirations into actionable steps that will help you make meaningful progress towards your dreams. Remember, short-term goals don’t have to be boring!

Whether you’re learning a new skill, connecting with new people, or saving up for a fun adventure, short-term goals can be exciting and fulfilling.

So, what are you waiting for? Grab a pen and paper and start setting some short-term goals today!

FAQs – Short-Term Goals

Short-term goals are essential for several reasons. They provide a clear direction and purpose, help you break down larger goals into smaller, manageable steps, build confidence and self-efficacy, and improve your overall productivity and performance.

Short-term goals are an essential component of achieving long-term goals. They help you break down larger objectives into smaller, more manageable steps and build momentum towards achieving your long-term vision. By setting and achieving short-term goals, you can stay motivated and focused, improve your skills and habits, and make progress towards your ultimate goals.

Prioritizing short-term goals depends on your personal preferences, needs, and circumstances. Consider which goals are most urgent, important, or aligned with your long-term vision. Prioritizing goals helps you focus your time, energy, and resources on the most critical objectives and avoid getting overwhelmed or distracted.

The number of short-term goals you should have at once depends on your capacity and workload. It’s generally best to focus on a few goals at a time to avoid getting overwhelmed or losing focus. Prioritize your goals based on their urgency, importance, and relevance to your long-term vision.